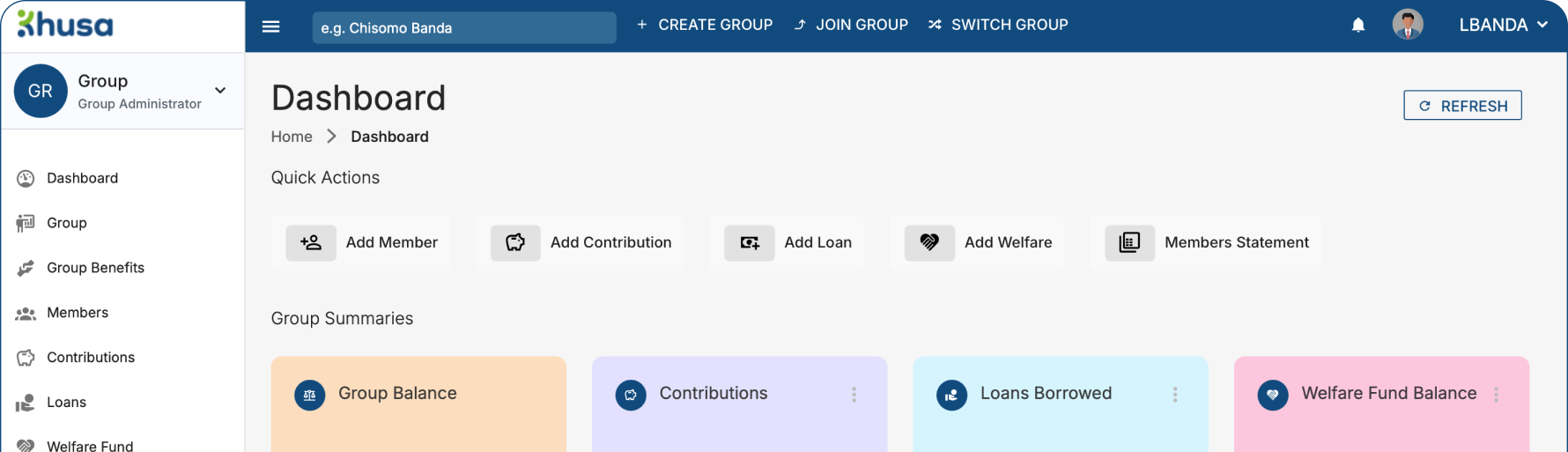

Khusa has been specially designed to suit your group operating procedures while giving you modern payment options.

Khusa gives you and your group the comfort of managing transactions electronically.

With the global pandemic of COVID-19 which has impacted a lot of business activities, community savings groups face the same challenge.

You only have to define your group rules once when setting Khusa up for the first time; once that is done, all your calculations for your group portfolio are done in the background!

Group member management has never been this easy with the member module which allows you to give access to your members with rights that allows them to keep up with the group’s activities.

This is your answer if you are a member or an organization that work with savings group popularly known as banki mkhonde.

Khusa web portal allows organizations that are working with different VSLA groups in various locations to be able to keep track.

Khusa gives you and your group the comfort of managing transactions electronically.

Find the following files for more infomation.

No downloads available for this product.